kansas sales tax exemption certificate

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Email Address The email address you used when registering.

. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation. Department of Revenue has been assigned a number. Each tax type administered by the Kansas.

This page discusses various sales tax exemptions in Kansas. PR-78ED 0714 Massachusetts Institute of Technology 77. An exemption certificate must be completed in its entirety and by regulation KAR.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Of are exempt from the sales tax local sales tax or compensating City State tax pursuant to KSA. Sales Tax Account Number Format.

Submit Request Begin the process of requesting a new tax clearance View Status View the status of a previously submitted request for tax clearance Verify Certificate Verify the authenticity of a tax clearance certificate or confirmation number. 79-3606 cc and amendments thereto if an HPIP certified business or KSA. An exempt entity will need to give an actual signed copy of their exemption certificate to each vendor from whom they make.

Burghart is a graduate of the University of Kansas. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. All construction materials and prescription drugs.

1 Exemption Certificates Pub KS-1520 Rev. Supplier in order for the Kansas salescompensating tax exemption to apply. Other Kansas Sales Tax Certificates.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Pursuant to the above section the project exemption certificate number below must appear on. Businesses with a general understanding of Kansas sales tax rules and regulations can avoid costly errors.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. It is designed for informational purposes only. Enter the Confirmation Number provided on the Certificate of Tax Clearance C000-0000-0000.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Sales Tax Exemptions in Kansas. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a tax-exempt entity like a government agency or tax-exempt nonprofitThe contractor must certify that the goods being purchased tax-free are exclusively for use on the tax-exempt entitys. The company can claim either the 15 percent credit or up to the 1125 percent whichever is less.

Your Kansas sales tax account number has three distinct parts. The certificate on file with other sales tax records. If you are accessing our site for the first time select the Register Now button below.

79-3606hhhh and amendments thereto if an agricultural business. Complete a Kansas Business Tax Application. Explain why the sale is exempt.

This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction Exemption Certificate for the sale to be exemptIf the out-of-state retailer DOES NOT have sales tax nexus with Kansas it may provide the third party. Your Kansas Tax Registration Number 000-0000000000-00.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource for commonly sought information. Password Passwords are case sensitive. Ad Fill out a simple online application now and receive yours in under 5 days.

SalesTaxHandbook has an additional three. For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date and can have an expiration date. While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation.

Ad New State Sales Tax Registration. Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the.

Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A. Fill out the Kansas resale exemption certificate form.

It explains the exemptions currently authorized by Kansas law and includes the exemption certificates to use. Kansas Sales Use Tax for the Agricultural Industry at. Sales and use tax.

The new certificates have an expiration date of October 1 2020. The renewal process will be available after June 16th. Tax Exempt entities located outside of Kansas who do regular business in.

Step 2 Identify the sellers name business address Sales Tax Registration Number and a general description of what products or services the business sells. Kansas Sales Tax Exemption Certificate information registration support. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

Order for the sale to be exempt. Step 3 Describe the tangible personal property or services the buyer will be purchasing. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Ov for additional information. The certificates will need to be renewed on the departments website. 1115 This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers.

The 004 is the number assigned to Retailers Sales Tax. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax AgreementPlease note that Kansas may have specific restrictions on how exactly this form can be used. How to use sales tax exemption certificates in Kansas.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

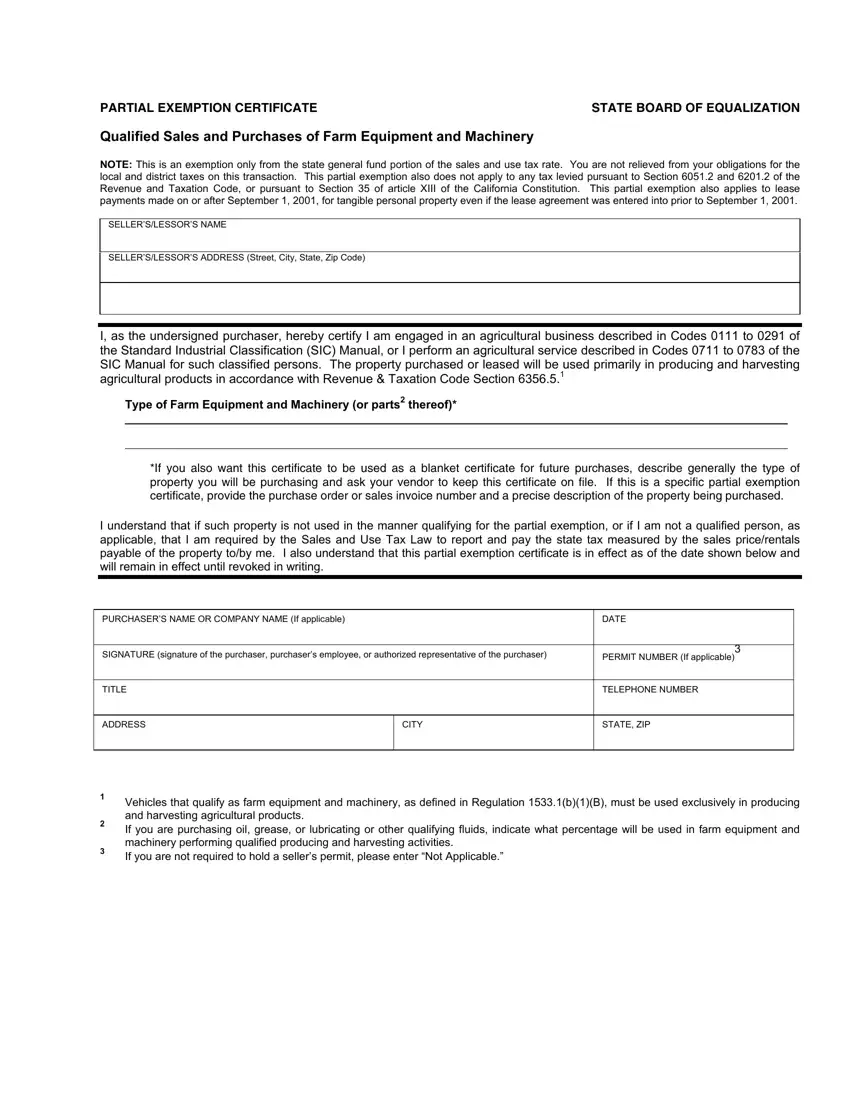

Partial Exemption Certificate Farm Fill Out Printable Pdf Forms Online

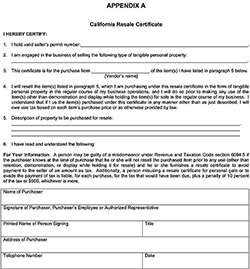

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Affordability And Livability Is In Our Hands Build Blog Affordable Housing Affordable House Plans Urban Design Concept

Editable Ordination Certificate Template Beautiful Deacon Ordination In Ordination Certificate Tem Certificate Templates Birth Certificate Template Certificate

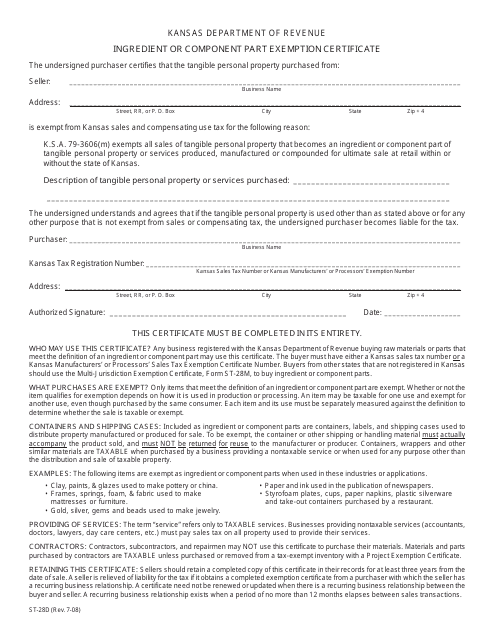

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Review The Requirements And Process For Obtaining An Employer Identification Number For Tax Employer Identification Number Employment Internal Revenue Service